- #BITPAY CARD LIMITS FOR FREE#

- #BITPAY CARD LIMITS HOW TO#

- #BITPAY CARD LIMITS OFFLINE#

- #BITPAY CARD LIMITS PLUS#

#BITPAY CARD LIMITS FOR FREE#

:max_bytes(150000):strip_icc()/monacocard-5a572bc7845b340037b71e9a.jpg)

#BITPAY CARD LIMITS PLUS#

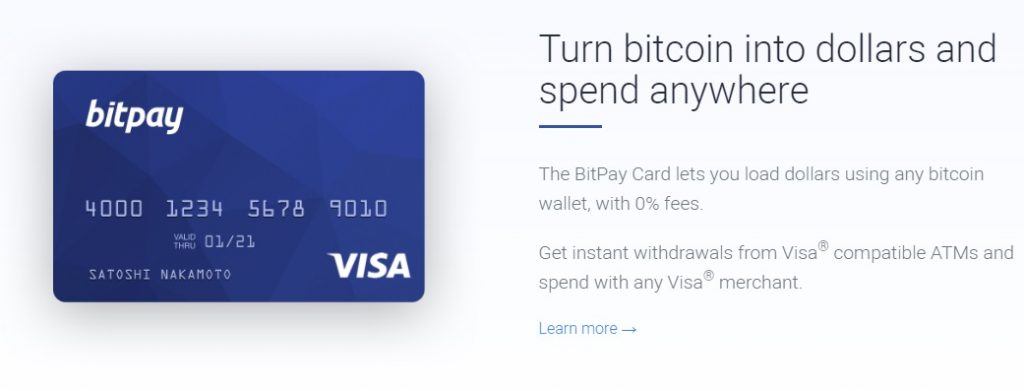

Cash withdrawal in foreign currency: £3.50 plus 3% of the transaction amount.Cash withdrawal in card currency: £2.50.CryptoPayĬountry Where the Company is Registered: London, United Kingdom. However, fees are relatively cheaper when you use other bitcoin debit cards. The Coinbase crypto debit card is issued by Paysafe and arguably offers the same grade of security and convenience as the Coinbase cryptocurrency exchange. Supported Cryptocurrencies: BTC, ETH, LTC, BCH, XRP, BAT, REP, ZRX, and XLM. To liquidate their crypto holdings, users pay a liquidation fee worth 2.49% of the transaction amount.International withdrawals attract a fee of 2% of the transaction amount for transactions above £200.Domestic Withdrawals attract a fee of 1% of the transaction amount for transactions above £200.Coinbase Crypto Debit CardĬountry Where the Company is Registered: United States It is issued by Payrnet for UK users and is available in a variety of colours that the company uses to differentiate the tiers of benefits attached. The MCO Visa Card is issued by popular cryptocurrency company,, formerly known as Monaco. Interbank Exchange Fees: 0.5% after a user exceeds the monthly free limit.Ĭashbacks: 1% paid in CRO and up to 8% for premium cardholders.

Monthly ATM Withdrawal Fee: 2% of the transaction after a user exceeds the monthly no-fee withdrawal limit. Supported Cryptocurrencies: Bitcoin (BTC), Coin (CRO), Ethereum (ETH), Litecoin (LTC), XRP, Basic Attention Token (BAT), Binance Coin (BNB), and many more. Supported Currencies: EUR, GBP, SGD, HKD, AUD, JPY. The country where the company is registered: Hong Kong, HK. Other cards require staking different amounts of CRO, ’s crypto token. Wirex is teasing the release of its Mastercard cards soon.Ĭost of Issuance: The basic MCO Visa card is Free. It offers instant crypto-to-fiat and fiat-to-fiat conversions, among other benefits. Launched in Europe in 2018, the Wirex crypto debit card is one of the most widely UK bitcoin debit card used in the UK. Supported cryptocurrencies: Bitcoin, Litecoin, Ethereum, XRP, WAVES, WLO, DAI, NANO, XLM, WXT.Ĭashbacks: 1.5% in Bitcoin for all in-store purchases Supported currencies: EUR, GBP, SGD, etc. Debit card payments in foreign currency cost €2.25 and 3% of the transaction value.Debit card payments in Europe attract a fee worth 3% of the transaction value.Cash withdrawals in Europe cost €2.25 plus 3% of the transaction value.The monthly maintenance fee is €1.20 or €14.4 annually.The country where the company registered: London, United Kingdom

#BITPAY CARD LIMITS HOW TO#

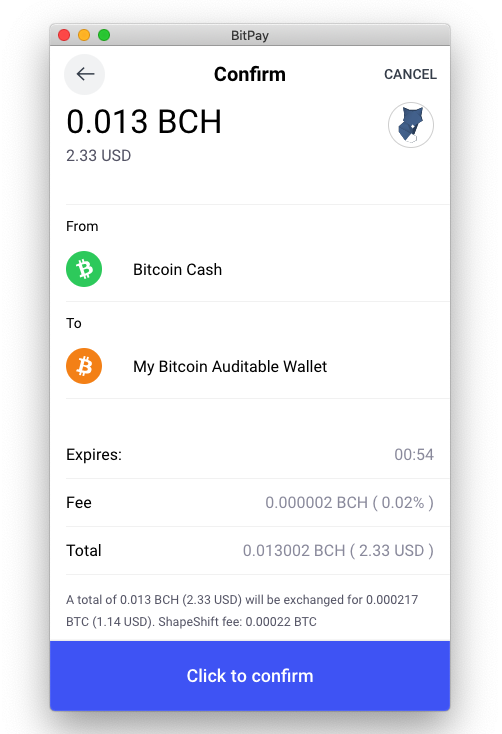

Next, we’ll share some information about how to choose from the various options available, and how to get started with the card. Now, that you understand how a Bitcoin debit card works, you may wonder what are the best crypto debit cards in the UK.įor the rest of this article, we’ll review the best bitcoin debit cards available to UK users. The market price of the assets at the time of the purchase is used to convert them to fiat and then used to settle the transaction.

#BITPAY CARD LIMITS OFFLINE#

Since most of them prefer to receive fiat for their goods and services, there had to be a way for cryptocurrency holders to still pay with their digital assets.Ī Bitcoin or cryptocurrency debit card allows users to shop online or offline while using their cryptocurrency assets to pay. Many merchants do not directly accept bitcoin or cryptocurrencies as a method of payment. But one might argue that if you have plenty of digital assets, you also want to be able to spend them when the need arises.Įnter bitcoin debit cards. Some are merely content with buying and holding cryptocurrencies to sell them for a lot more in the future.

0 kommentar(er)

0 kommentar(er)